Penalties on 1099 MISC Form Just like every other form of the IRS, the 1099 MISC form too when one fails to comply with the correctness, guidelines, and deadlines A taxpayer will have to pay a fine of $50 if the last date deadline has been missed but still is within 30 daysNote 1 Form 1096 will be generate automatically based on form 1099 information 2 ezW2 allows user to set up unlimited companies with one flat rate So if you have multiple companies or you are an accountant, you can add new company by clicking top menu "Company Management>New company" 3 The csv file data2//19 · 24 posts related to Sample Completed 1099 Misc Form Sample 1099 Form Completed 1099 Misc Template 17 Unique Sample 1099 Form Luxury 24 Fresh Image 1099 Form Template Word

How To Fill Out A 1099 Misc Form

How to fill out 1099 misc form

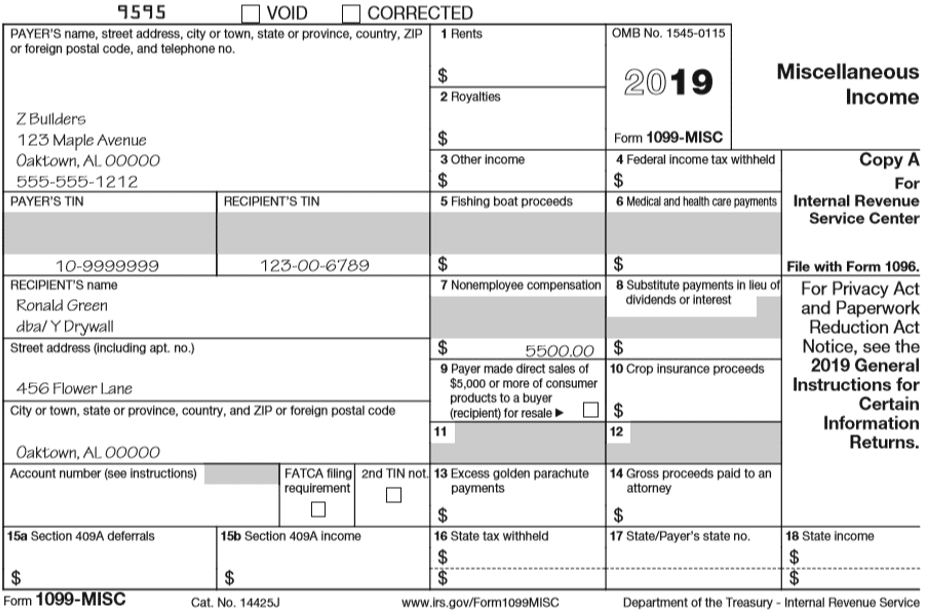

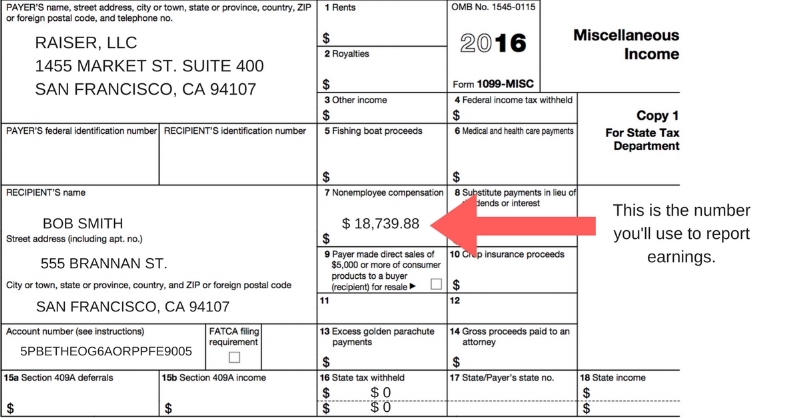

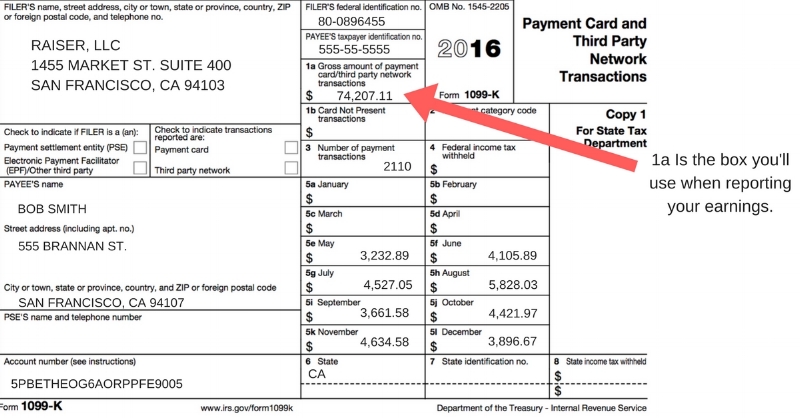

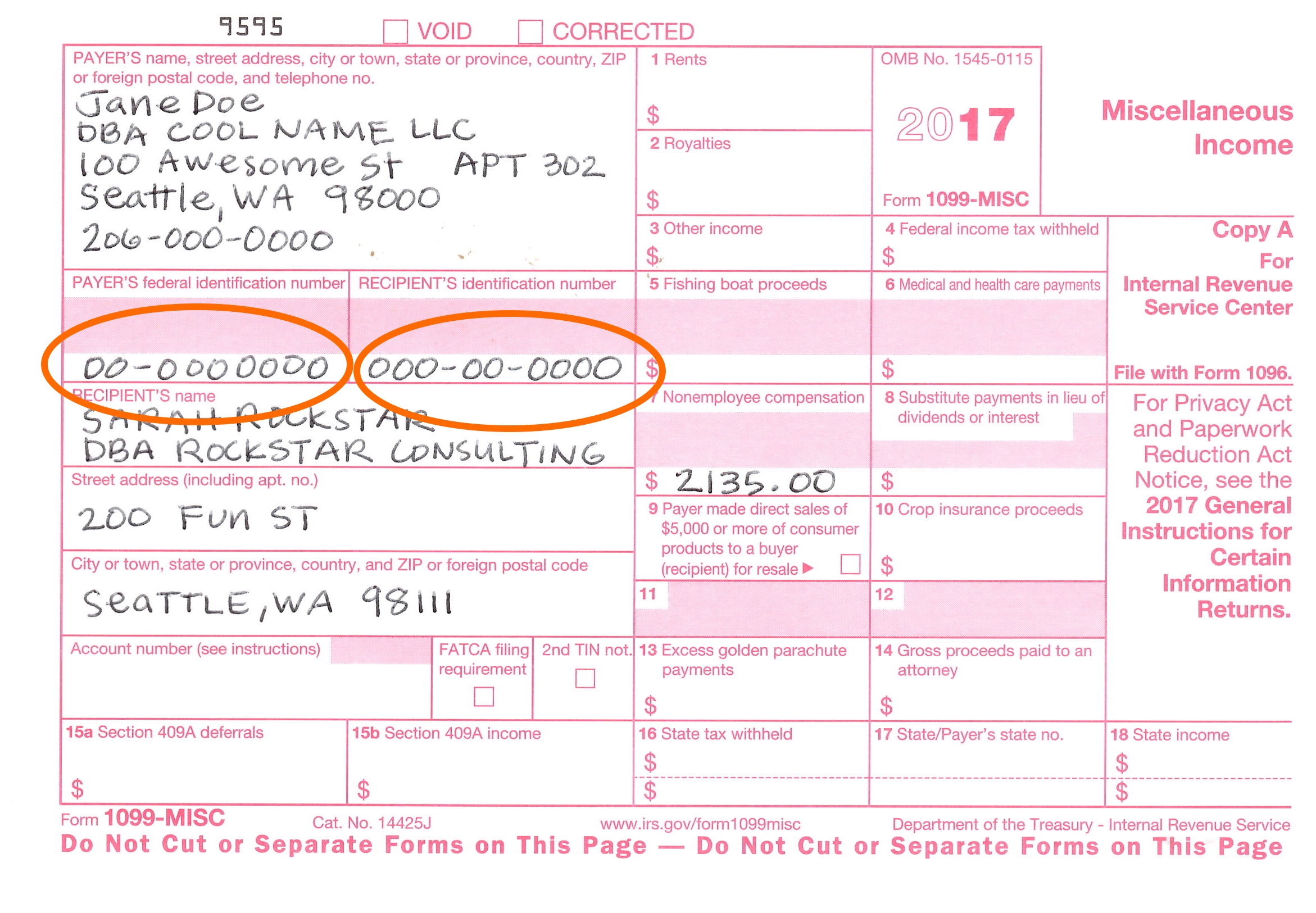

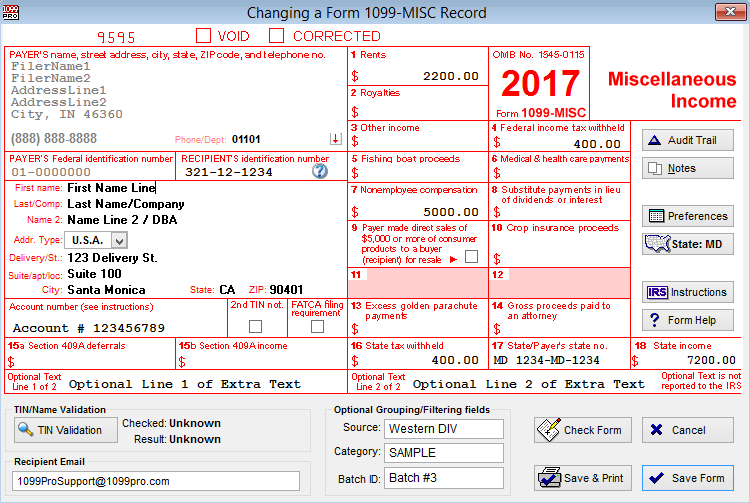

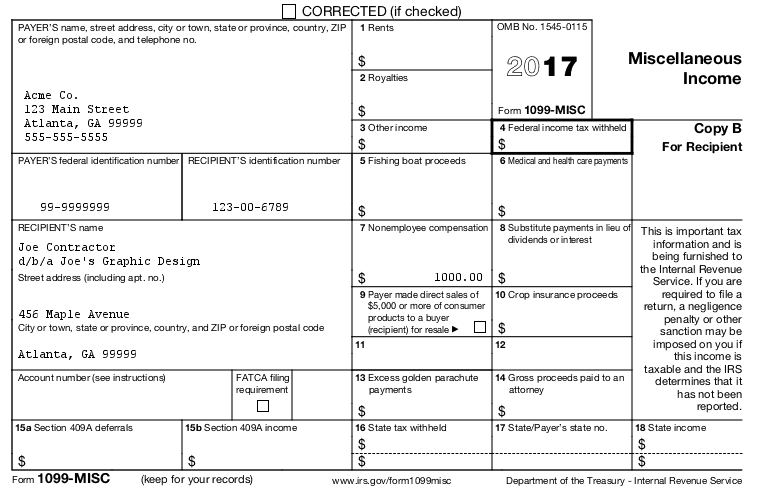

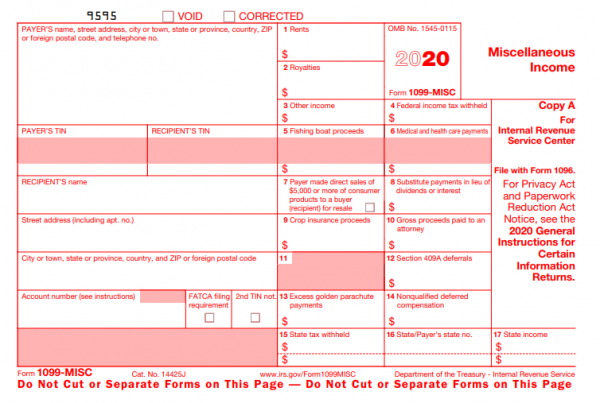

How to fill out 1099 misc form-Your TIN (Taxpayer Identification Number) Recipient's TIN;Form 1099MISC 12 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city, state, ZIP code, and telephone no PAYER'S federal identification number RECIPIENT'S identification number RECIPIENT'S name

1099 Misc 14

3/25/17 · How to fill out boxes 15a and 15b on 1099MISC If applicable, enter any Section 409 deferrals and deferral amounts included as income How to fill out boxes 1618 on 1099MISC form Enter state tax withheld from payment in box 16 along with the payer state's name and identification number in box 17 and the amount of state payment in box 181/7/14 · Sample of completed 1099 MISC form click for larger image Corporations Do I need to issue 1099 forms for payments made to corporations?1099 misc form Complete blanks electronically utilizing PDF or Word format Make them reusable by making templates, add and fill out fillable fields Approve documents by using a lawful electronic signature and share them by using email, fax or print them out Save blanks on your PC or mobile device Boost your efficiency with powerful solution!

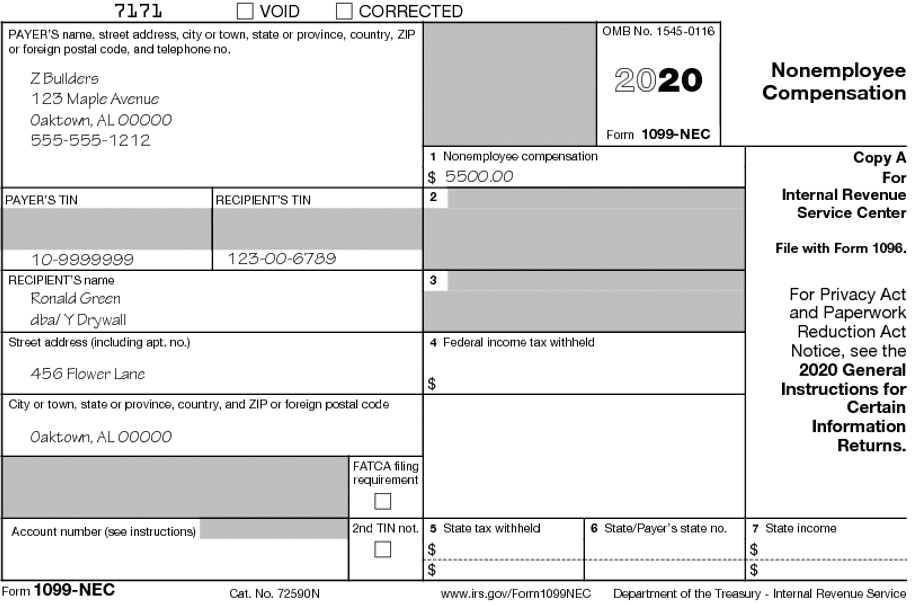

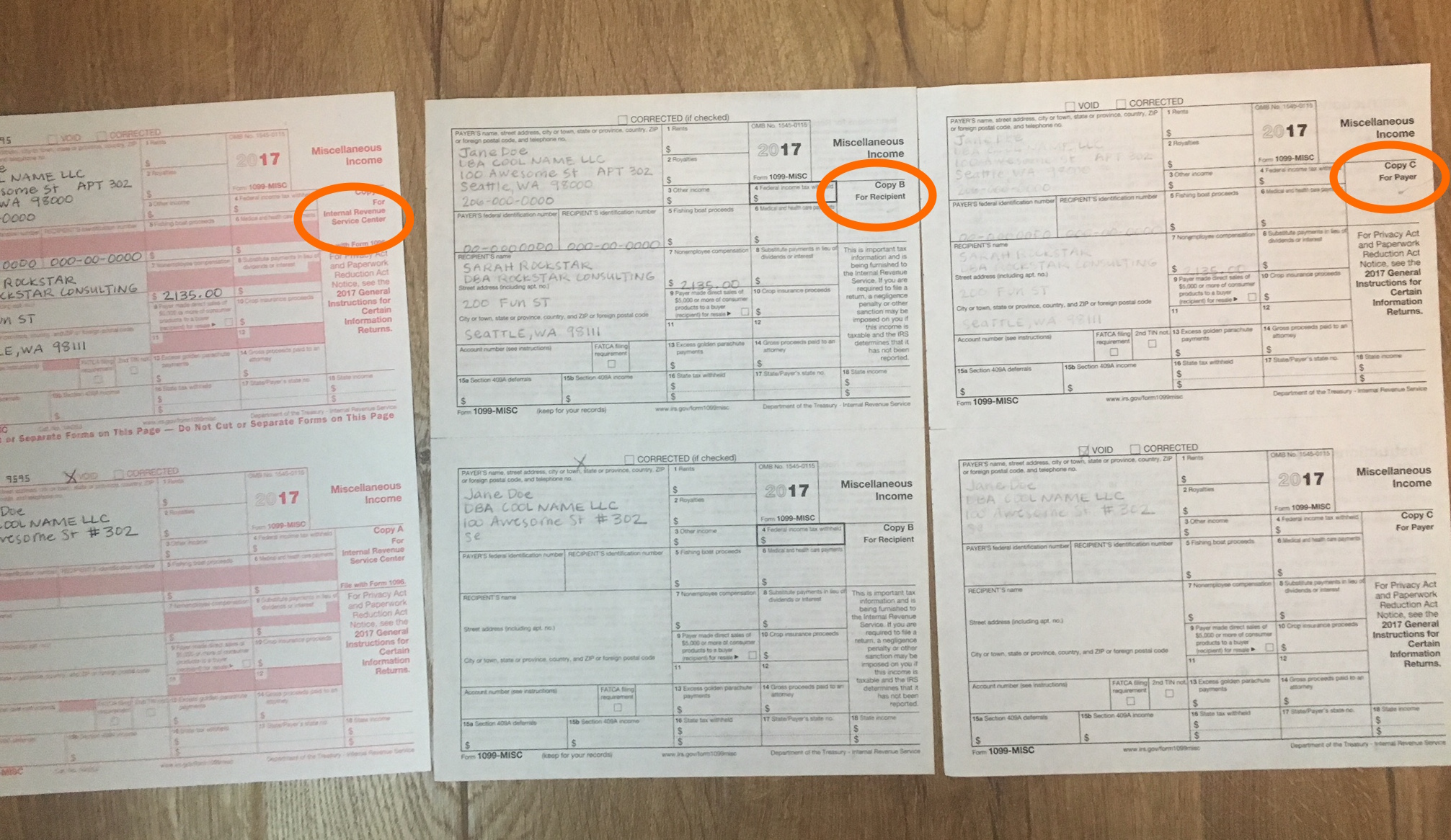

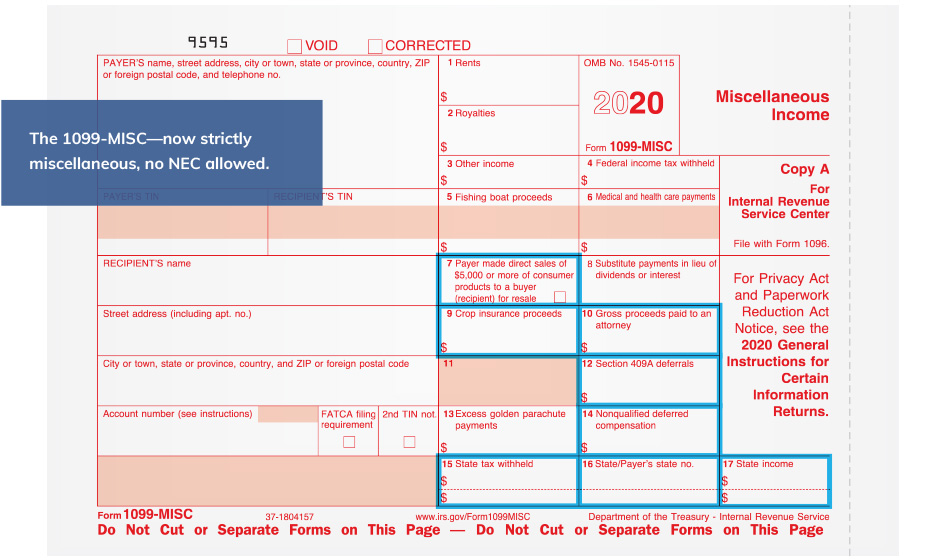

Your account number, if applicable;Redesigned Form 1099MISC Due to the creation of Form 1099NEC, we have revised Form 1099MISC and rearranged box numbers for reporting certain income Changes in the reporting of income and the form's box numbers are listed below • Payer made direct sales of $5,000 or more (checkbox) in box 7 • Crop insurance proceeds are reported in box 9Furnish 1099 MISC Copy B to the recipient by February 1, 21The due date for box 8 or 10 of this form is extended to February 16, 21 File Copy A of this IRS 1099 MISC form with the IRS by March 1, 21, if you file on paperOr, it is by March 31, 21, if you file electronically

1099 MISC Copy A;Important The information in this sample is specific to RUN Powered by ADP® only and should not be used as the official 1099NEC In addition to this In addition to this sample, it's important that you use the detailed instructions for Form 1099NEC found here https//wwwirsgov/pub/irspdf/i1099mscpdf2/18/21 · A very active Airbnb listing for which hosts have more than 0 guest bookings per year would be an example of side income that would lead to issuance of a 1099K Ridesharing drivers will also receive a Form 1099K for gross ride receipts accrued during the tax year, in addition to a Form 1099MISC Form 1099LTC Reports longterm

How To Fill Out A 1099 Misc Form

Instant Form 1099 Generator Create 1099 Easily Form Pros

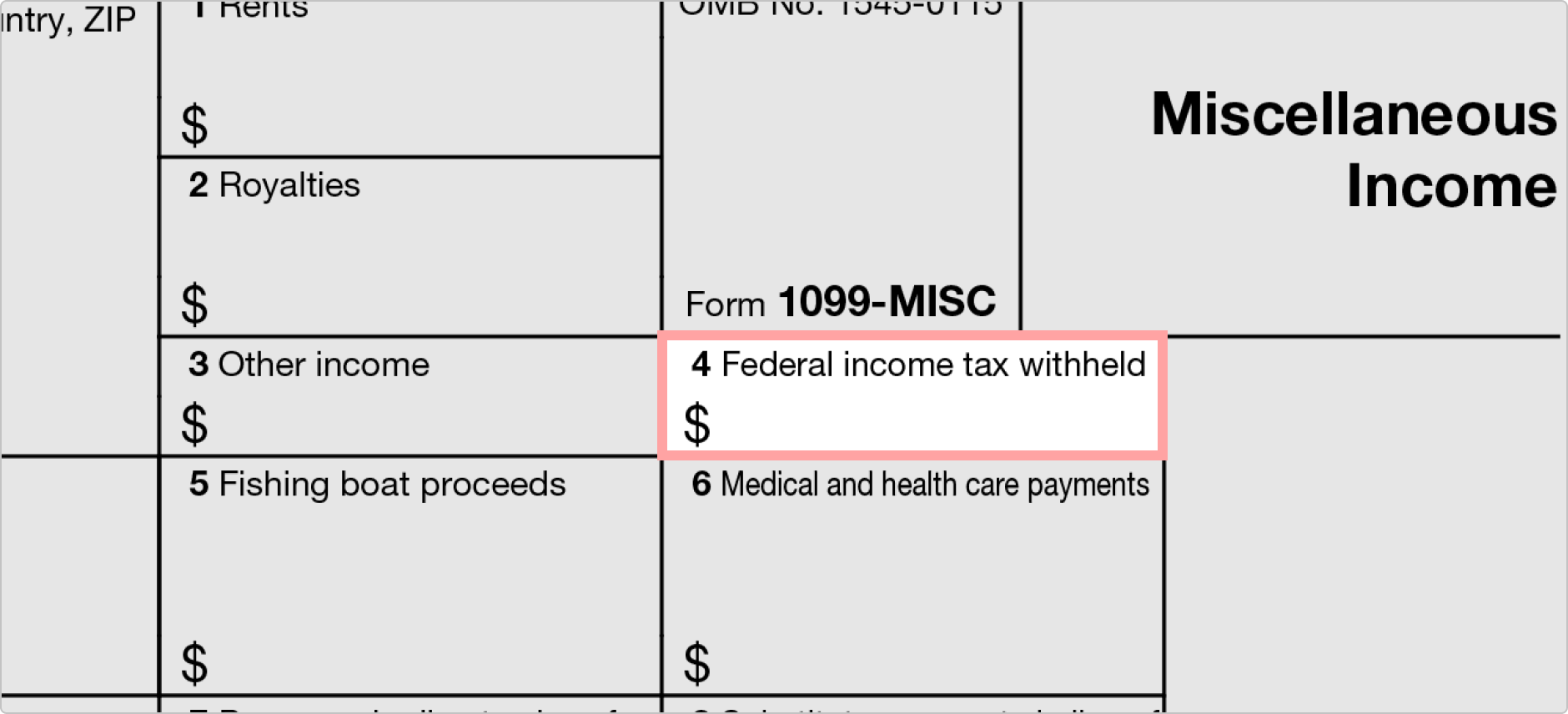

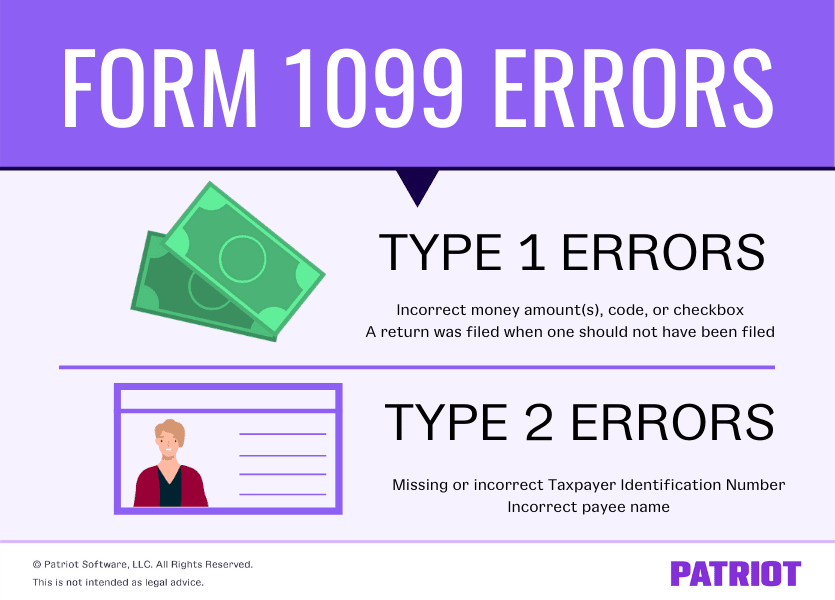

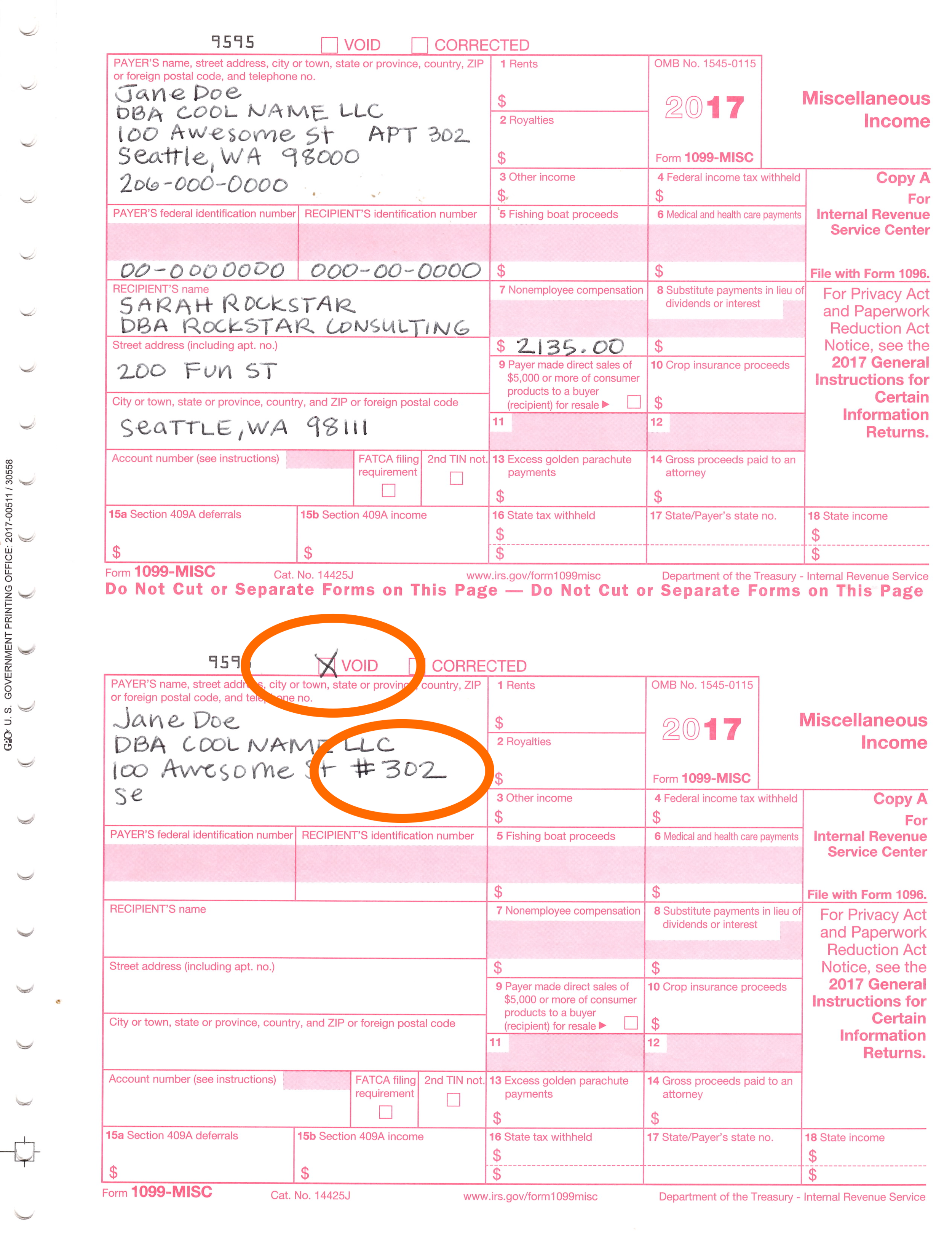

12/1/ · If you're sending both Form 1099MISC and Form 1099NEC, you need two separate Forms 1096 (one to accompany each form) Common 1099 errors that require a 1099 correction First and foremost, you only need to issue a corrected 1099 to the IRS if you already submitted an incorrect form to the IRSTo view examples of these forms you can click on the links below To view a 1099B go here click here To view a 1099MISC go here click here If you have received either a 1099B or a 1099MISC you may have had withholdings from the income If so, you must report your federal withholdings from box 4 separately to receive credit for theseForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Who Should Receive Form 1099 Misc

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

11/3/ · Before you fill out Form 1099MISC, you need to gather some information You should have the following on hand to fill out the 1099MISC form Payer's (that's you!) name, address, and phone number;More than 70% of filers in 19 reported information in Box 7 of form 1099MISC2/10/19 · Sample Completed 1099 Misc Form Sample Cms 1500 Form Completed Completed Cms 1500 Claim Form Sample Sample Cms 1500 Claim Form Completed Sample Completed Hcfa 1500 Form Sample Completed 1500 Claim Form 1099 Misc Template 17 Unique Sample 1099 Form Best Sample Resume For Freshers Forms And

E X A M P L E O F 1 0 9 9 M I S C F O R M Zonealarm Results

What Are Irs 1099 Forms

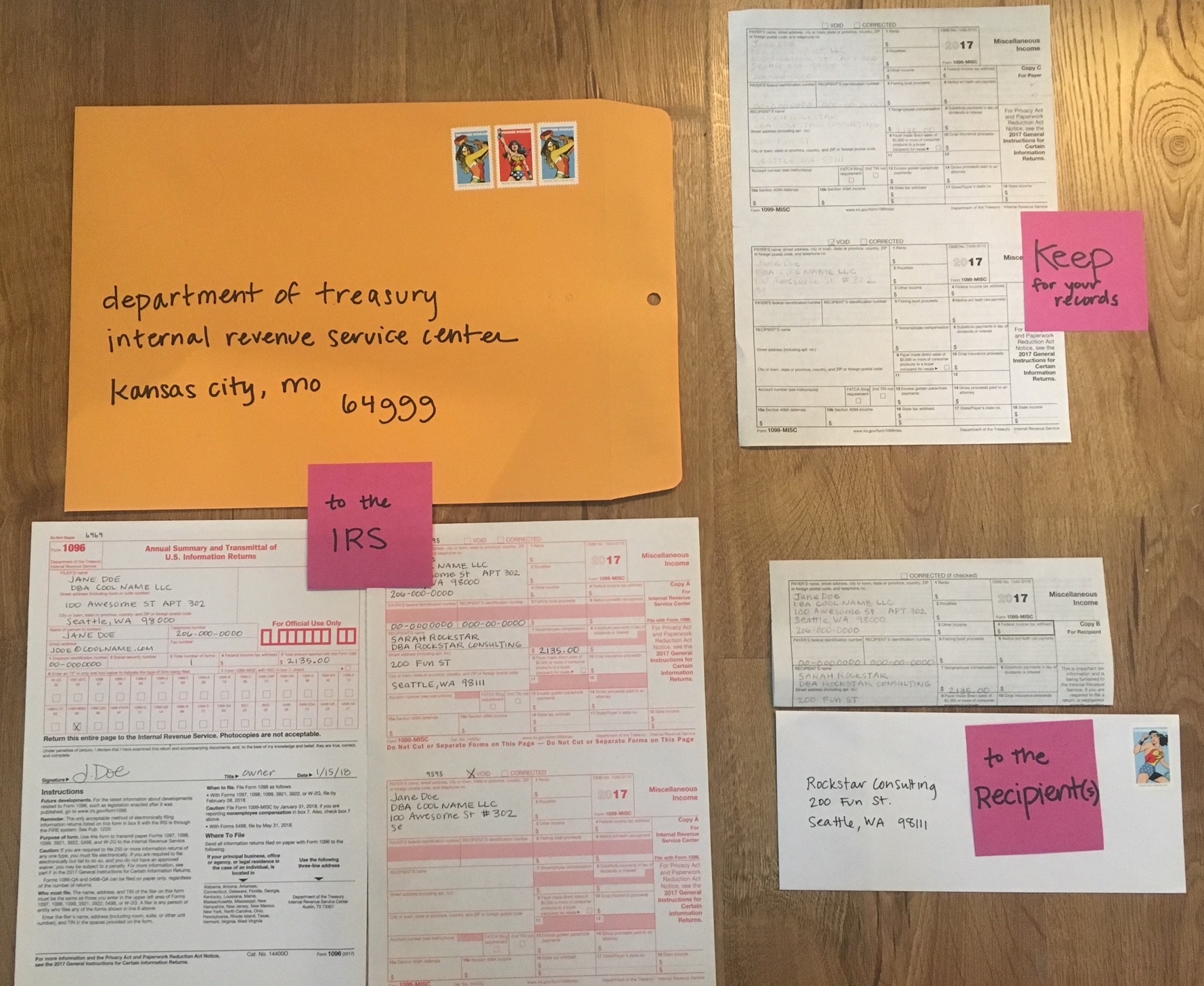

Step 2 Complete Form 1099MISC using the information you gathered in Step 1 Step 3 Submit Copy B to the Contractor no later than January 31 so they can file their own taxes by the deadline Step 4 Submit Copy A to the IRS by February 28 if you'reMore than 70% of filers in 19 reported information in Box 7 of form 1099MISC This year, the IRS is requiring those filers to use form 1099NEC instead of 1099MISC If you need to report nonemployee compensation for the tax year, you will need to use the 1099NEC form ***All tax forms currently in stock!Miscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 states IMPORTANT You may need to use the new 1099NEC form with or instead of the 1099MISC!

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Amount you paid the recipient in the tax year;Form 1099MISC, for Miscellaneous Income, is a tax form that businesses complete to report various payments made throughout the year One Form 1099MISC should be filed for each person or nonincorporated entity to whom the business has paid at least $10 in royalties or at least $600 for items such as rent and medical or health care paymentsNo, in general you do not need to issue 1099 forms for payments you made to a corporation For instance, if you pay a corporation that, say, provides Web design services or some other business service, you

1099 K Tax Basics

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

1099 Form Printable 18 Fill out, securely sign, print or email your 1099 INT Fillable Form 1718 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Assuming that you are talking about 1099MISC Note that there are other 1099scheck this post Form 1099 MISC Rules & RegulationsQuick answer A Form 1099 MISC must be filed for each person to whom payment is made of$600 or more for services performed for a trade or business by people not treated as employees,Rent or prizes and awards that are not for service ($600 or1099 Misc Form Fill out, securely sign, print or email your 19 Form 1099MISC IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

How To Fill Out 1099 Misc Irs Red Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Recipient's name and address;11// · Form 1099MISC is still in use for the tax year and beyond, but it no longer includes nonemployee compensation It reports payments such as rents, prizes and awards, medical and health care payments, nonqualified deferred compensation, consumer goods for resale, and royalties —basically miscellaneous payments to anyone who isn't an independent3/9/21 · A 1099 is a document or a series of documents used by the IRS to track different types of income, other than salary, received from an employer At the end of each year, it is the responsibility of the person paying to provide a completed 1099 form to the person they pay

An Employer S Guide To Filing Form 1099 Nec The Blueprint

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

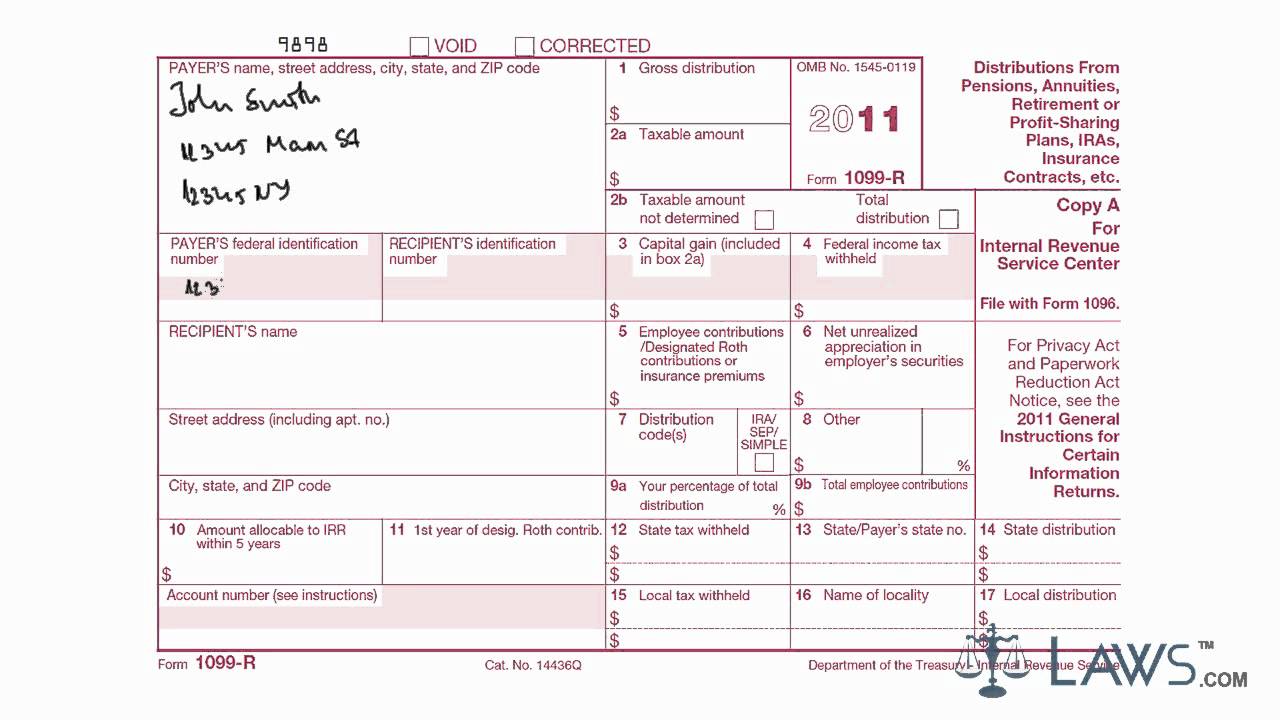

1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes only1/16/16 · Form 1099Misc needs to be provided for Royalties of $10 or more Significance for payer Liability If the payer does not file Form 1099MISC, there is a maximum penalty of $250 per form not filed, up to $500,000 per year Otherwise for late filings the penalty varies from $30 to $100, depending on how late the filing was7// · With this form, you may also need to complete Form 1099NEC and report the sale again, but in number format If You Withheld Federal Income Taxes for Anyone Under the backup withholding rules, you must file Form 1099NEC for anyone from whom you have withheld federal income tax, regardless of the amount, even if it's less than $600

1099 Misc 14

How To Time Prepping Your 1099 Misc

How to fill out Form 1099MISC7/8/ · The 1099NEC form is the independent contractor tax form Use it to report to your contractors, and to the IRS, how much they were paid over the course of the tax year You only need to file 1099sHiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check At the end of the year you may also need

How To Fill Out 1099 Misc Irs Red Forms

1099 Misc Instructions And How To File Square

Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below10/27/17 · How to Fill Out a 1099MISC Form As a small business owner or selfemployed individual, below are the steps to fill out a 1099MISC form Step One Enter your information in the 'payer' section Complete your personal details in the box in the topleft corner, including your full names, home address, contact number etc Step TwoThe Form 1099Miscellaneous Income statement reports an owner's gross income paid by Chesapeake prior to any other deductions or taxes The form will also list any state or US withholding amounts deducted from a revenue check

Form 1099 Misc It S Your Yale

How To Fill Out Form 1099 Misc Youtube

Form 1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTEDThe form samples include samples for preprinted as well as BIP versions of the 1099 forms You use the preprinted version ZJDE0001 for printing the form output on the office supply stock of 1099 forms where you only create the data on the already printed form However, when you use the BIP version, the system creates the entire form as well as the6/9/18 · D Frank Date February 26, 21 Information reported on a 1099 Form is used to complete a person's 1040 Form as part of a federal tax return In the United States, corporations, small businesses and other employers use a variety of forms to record the income earned by employees and independent contractorsTypically, employees of a business in the US receive a W2 form

1099 Misc Public Documents 1099 Pro Wiki

Understanding 1099 Form Samples

· Instead, you must obtain a physical Form 1099NEC, fill out Copy A, and mail it to the IRS Learn how to get physical copies of Form 1099MISC and other IRS publications for free 3 Submit copy B to the independent contractor Once your Form 1099NEC is complete, send Copy B to all of your independent contractors no later than January 31, 211099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus Rents and Royalties 3 ATTORNEY 1099MISC Box 3 Other Income plus Attorney & Medical Payments Perfect for attorneys 4 1099Nonemployee compensation will be reported to the taxpayer using Form 1099NEC with the nonemployee compensation listed in box 1 All prior years will still use the 1099MISC for nonemployee compensation The two most common entries on Form 1099MISC are Box 3, Other Income and Box 7, Nonemployee Compensation

Performing 1099 Year End Reporting

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Form 1099MISC Miscellaneous Income (or Miscellaneous Information, as it's called starting in 21) is an Internal Revenue Service (IRS) form used to report certain types of miscellaneousBasic 1099MISC Filing Instructions To complete a 1099MISC, you'll need to supply the following data Business information – Your Federal Employer ID Number (EIN), your business name and your business address Recipient's ID Number – The recipient's Social Security number or Federal Employer ID Number (EIN) Payment Amounts – Enter amounts paid in the appropriate boxHow to fill out form 1099misc?Get the BUSINESS SPREADSHEET TEMPLATE for your selfemployed or LLC accounting & taxes here http//wwwamandarussellmba/gett

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

The sample is sent by you to the party that is providing paid servicesThe selfemployed person or freelancer should complete the W9 form correctly, as it includes details, used to fill out 1099MISC The minimal sum, necessary for reporting with this sample is $6003/29/21 · The new Form 1099NEC has replaced 1099MISC to report nonemployee compensation Your contractors are valuable workers, and you need to submit accurate tax information on their behalf The first step is to determine whether each worker is an independent contractor or an employee

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Form 1099 Misc Vs Form 1099 Nec How Are They Different

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

How To File 1099 Taxes Online Unugtp

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Gosling Company Certified Public Accountants

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

How To Fill Out An Irs 1099 Misc Tax Form Youtube

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

1099 Misc Form Fillable Printable Download Free Instructions

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

1099 Misc Software To Create Print And E File Form 1099 Misc Fillable Forms Irs Forms Accounting

1099 Tax Software Blog 1099 Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Misc It S Your Yale

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

1099 Printing Software Form 1099 Filing Software

1099 Form Fileunemployment Org

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

New Form 1099 Reporting Requirements For Atkg Llp

1099 Misc Form Fillable Printable Download Free Instructions

Federal 1099 Filing Requirements 1099 Misc 1099 K

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

Understanding Form 1099 Misc And Changes That Are Coming In S J Gorowitz Accounting Tax Services P C

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

What Are Irs 1099 Forms

Printable 1099 Misc Form 17 Best Of Sample 1099 Misc Filled Out Unique Free Forms 18 Misc Forms 2mc Models Form Ideas

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

1099 Misc Form Fillable Printable Download Free Instructions

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Misc Katopia Design

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Sample 1099 Misc Forms Printed Ezw2 Software

What Is The Account Number On A 1099 Misc Form Workful

How Do You File 1099 Misc Wp1099

How To Use The New 1099 Nec Form For Dynamic Tech Services

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

Form 1099 Misc Instructions And Tax Reporting Guide

How To Fill Out 1099 Misc Irs Red Forms

Your Ultimate Guide To 1099s

Understanding Your Tax Forms 16 1099 Misc Miscellaneous Income

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

1099 Misc Form Fillable Printable Download Free Instructions

You Can T Trust Your 1099s Endovascular Today

The New 1099 Nec

1099 Misc Software To Create Print E File Irs Form 1099 Misc

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Irs 1099 Misc Form Pdffiller

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Fillable 1099 Form 16 1099 Fillable Form Fill For 1099 Fillable Form 17 1099 Resume Examples Form Example Fillable Forms

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

How To Fill Out And Print 1099 Misc Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

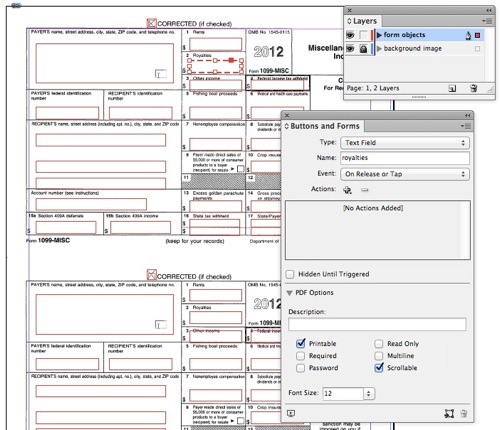

Making A Fillable 1099 Misc Pdf For Printing Creativepro Network

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Tax Basics

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

0 件のコメント:

コメントを投稿